PTRK

+1

Jan 8, 2026

•

8 min read

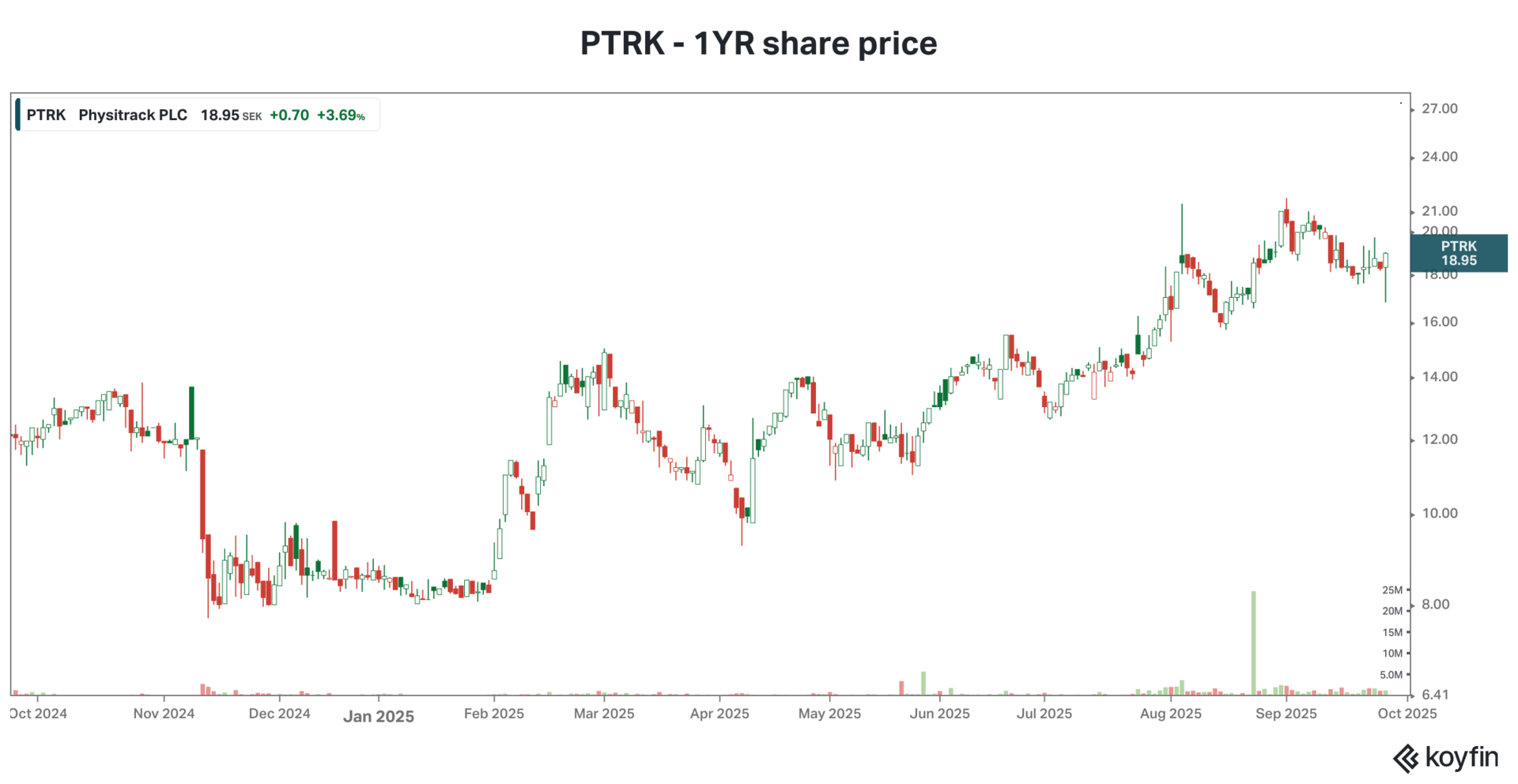

Physitrack (PTRK): The Thesis Still Holds

Lind comments on the latest news from PTRK and does an investment thesis check-in due to the recent poor share price performance.

SLEEP

+1

Dec 18, 2025

•

4 min read

Sleep Cycle (SLEEP): Major SDK Licensing Deal Announced

Lind comments on the SDK licensing deal and how it aligns with our long-term investment thesis.

EMBRACB

+1

Dec 9, 2025

•

3 min read

Embracer Group (EMBRACB): 30% Drop Reveals an Attractive Implied Coffee Stain Valuation

Embracer’s share price fell 29.8% yesterday to SEK 60 as the stock began trading without the rights to Coffee Stain Group. The decline reflects the arithmetic removal of a subsidiary, not a deterioration in Embracer’s operations.

PTRK

+1

Dec 5, 2025

•

12 min read

Physitrack (PTRK): Extremely Favorable Risk-Reward Situation

Lind updates on the latest events: the Q3 report and divestment of clinics. Furthermore, we view the value disconnect as significant following an unjust share price decline.

EMBRACB

+1

Nov 26, 2025

•

5 min read

Embracer (EMBRACB): Unleashing the GOAT

Lind comments on the announced trading date of Coffee Stain and the divestment of ARC Games and Cryptic Studios.

PTRK

+1

Nov 26, 2025

•

4 min read

Physitrack (PTRK): Strategic Restructuring Aligns With Long-Term Value Creation

Lind comments on PTRK's strategic divestment of non-SaaS assets within the Wellness segment. We view the move positively and that it aligns with our long-term investment thesis of PTRK.

EMBRACB

+1

Nov 14, 2025

•

1 min read

Embracer (EMBRACB): Soft Quarter Ahead of CSG Spin-Off

Lind provided a short earnings comment on Embracers’ Q2 report. Embracer delivered a mixed Q2’25/26, with net sales slightly ahead of expectations but continued weakness in PC/Console dragging margins. Organic growth of 6% and steady performance in Entertainment & Services support an unchanged full-year outlook, with Q4 still expected to be the key release quarter. Near-term estimate changes appear limited, while the upcoming Coffee Stain spin-off remains the clearest catalyst given the market’s discount to the unit’s underlying quality.

PTRK

+1

Oct 24, 2025

•

1 min read

Physitrack (PTRK): Market Misses the Cash-Flow and SaaS Quality Shift - Earnings comment

Physitrack’s Q3 confirmed steady progress in its SaaS transition, with EBITDA up 25% and free cash flow turning positive for a fourth consecutive quarter. Lifecare remains the core profit driver, growing ARR 13% YoY and delivering sector-leading margins, while Wellness has nearly reached breakeven following a successful cost reset. Despite these structural gains, the group trades at just ~1.8x EV/S 2026E—far below SaaS peers valued at 5–6x—leaving significant upside once sentiment normalizes and cash generation becomes more visible.

SLEEP

+1

Oct 24, 2025

•

1 min read

Sleep Cycle (SLEEP): Diversification Gaining Momentum, but Capital Allocation Now Critical - Earnings comment

Sleep Cycle’s Q3 confirms steady progress in its transition from a pure subscription model to a broader sleep-tech platform. Partner revenue surged 55% YoY and now represents 11% of total sales, offsetting part of the continued subscriber decline. Despite high margins, a cash-rich balance sheet, and EV/EBIT below 6x, the market still prices in structural decline. We believe sentiment can only shift through decisive capital deployment—particularly buybacks—to signal management’s confidence and unlock the clear valuation gap.

BETCO

+1

Oct 17, 2025

•

2 min read

Better Collective (BETCO): Unlicensed Exposure on HLTV.org

Field tests confirm that HLTV.org, owned by Better Collective, promotes GG.bet—an unlicensed operator banned by Sweden’s regulator—while remaining accessible from Swedish IPs and accepting SEK deposits. This constitutes illegal marketing under the Swedish Gambling Act, exposing BETCO to compliance scrutiny and reputational damage.

SLEEP

+1

Sep 30, 2025

•

3 min read

Sleep Cycle (SLEEP): Wake-up Call - Conviction Case

We are releasing a Conviction case on Sleep Cycle (SLEEP), a market-leading sleep technology company listed on Nasdaq Stockholm Small Cap.

PTRK

+1

Sep 26, 2025

•

3 min read

Physitrack (PTRK): European Insurer Deal Extends MSK Reach - Research Note

MSK-deal opens a new pathway.

EMBRACB

+1

Sep 18, 2025

•

6 min read

Embracer Group (EMBRACB): Value Creative Buybacks - Conviction case

Spin-off, insider buying, and now a buyback program.

TALK

+1

Sep 1, 2025

•

3 min read

Talkpool (TALK): Micro Cap Growth - Idea Note

Talkpool has reshaped itself into a lean, cash-generative network services firm following the IoT divestment. With steady organic growth and improving margins, current earnings already cover most of its enterprise value. Modest growth and normalization could drive the EV/EBIT below 4x by 2028, suggesting attractive valuation potential.

PTRK

+1

Aug 26, 2025

•

2 min read

Physitrack (PTRK) - Overhang Lifted, Path to Fair Value Clears

The exit of non-operative co-founder Nathan Skwortsow via an off-market placement on August 22 removes a key overhang that had weighed on Physitrack’s share price. The block was placed at SEK 16.20, with shares rebounding to SEK 18.50 as new institutional investors entered. With fundamentals unchanged and sentiment improving, our conservative SOTP analysis supports an intrinsic value of around SEK 26 per share, implying substantial upside from current levels.

EMBRACB

+1

Aug 23, 2025

•

2 min read

Embracer Group (EMBRACB): Coffee Stain Spin-off Poised to Unlock SEK 9bn in Hidden Value - Conviction Case

The planned 2025 Coffee Stain spin-off could reveal SEK 9bn in value, underscoring the studio’s industry-leading margins and capital efficiency. With Fellowship Entertainment implied at just ~2.7x EBIT and heavy insider buying signaling conviction, we see a clear path toward a 50–80% upside as the valuation gap narrows.

BETCO

+1

Aug 18, 2025

•

3 min read

Better Collective (BETCO) - July Traffic Tracker Update

Traffic decline accelerating.