LIND RESEARCH

Research Update | Premium Research

Extremely Favorable Risk-Reward Situation

Physitrack (PTRK) is currently trading at 13.15 SEK at the lower bound of its 52-week range of 8.0-21.7 SEK. The share price has decreased sharply since mid-September for no apparent reason; meanwhile, the business continues to strengthen, and strategic initiatives to improve profitability and durable growth are underway.

Recent development: PTRK shows strong fundamentals and an ongoing turnaround, but the share price doesn't reflect this. Physitrack reported a solid Q3, with better margins and cash flow, indicating progress in its SaaS transition. Divesting the clinical business aims to shift from low-margin legacy revenue to a focus on SaaS in healthcare software.

Investing in the USA: PTRK has recently ramped up hiring in the USA, a key strategic market. Although North America only accounts for about 18-20% of PTRK's revenue, this hiring surge suggests robust market momentum. A USA-focused deal could be announced soon, given the country's large size and PTRK's strong positioning to capitalize on significant structural changes in the US healthcare sector.

Value gap: Between 2025 and 2027, PTRK's EBITDAC is expected to double, fueled by expansion in its Lifecare and Wellness SaaS segments. However, the market currently undervalues this growth, resulting in a substantial value gap and disconnect.

Since our initial research report, the case has become considerably less risky. PTRK has carried out most of the value-adding steps we suggested, yet the share price has fallen back to its pre-coverage levels. As a result, we see a very favorable risk-reward profile at present. The main risk remains if the Nordic micro- and small-cap sector continues to decline, potentially delaying market revaluation.

Valuation & investment rating: We set our 12-month target price for PTRK at…

🔒 Unlock the rest with Premium, get 30 days of free access.

Info | Value |

|---|---|

Co: Physitrack | Price (SEK): 13.15 |

Ticker: PTRK | Mcap (€m): 19.5 |

FYE: DEC | EV (€m): 23.8 |

(€m) | 2024 | 2025E | 2026E |

|---|---|---|---|

Sales | 🔒 | 🔒 | 🔒 |

aEBITDA | 🔒 | 🔒 | 🔒 |

aEBIT | 🔒 | 🔒 | 🔒 |

S. Growth | 🔒 | 🔒 | 🔒 |

EBITDA-m | 🔒 | 🔒 | 🔒 |

EBIT-m | 🔒 | 🔒 | 🔒 |

EV/S | 🔒 | 🔒 | 🔒 |

EV/EBITDA | 🔒 | 🔒 | 🔒 |

EV/EBIT | 🔒 | 🔒 | 🔒 |

Disclaimer

This analysis represents the independent views of Lind Research and is based on publicly available information believed to be reliable, but no warranty is given as to its accuracy or completeness. Nothing herein is investment advice or a recommendation. We publish openly, and companies do not influence our conclusions. Lind Research may hold positions in securities discussed.

Analyst owns shares? Yes.

Company overview

We have written about Physitrack (PTRK) extensively before, but as there are many new subscribers, we find a reminder of what the company does beneficial.

PTRK is listed on Nasdaq First North in Stockholm with an enterprise value hovering around SEK 260m ($27.3m). PTRK is a healthcare software provider within physiotherapy and corporate wellness. Led by the founder and majority owner, Henrik Mollin. The company operates two segments: Lifecare and Wellness.

Lifecare

The Lifecare segment offers a cloud-based SaaS platform for healthcare professionals (physiotherapists, occupational therapists, surgeons) managing patient care from consultation to outcome tracking. Key features include:

Exercise Prescription and Education: A library of over 12,000 exercises with video and customizable templates for tailored treatment plans.

Telehealth Integration: Secure video consultations with real-time exercise streaming, goniometric tools, and symptom tracking to improve remote access to care.

Outcomes Tracking and Analytics: The PhysiApp collects patient-reported outcomes (adherence, functional progress) and displays them in dashboards for data-driven treatment adjustments.

Lifecare serves a range of providers, from small clinics to large hospitals and insurers, and offers a white-label option. It has been shown to reduce hospital readmission rates in post-discharge rehabilitation through real-time monitoring. The segment has strong customer retention, evidenced by a 1.0% churn rate.

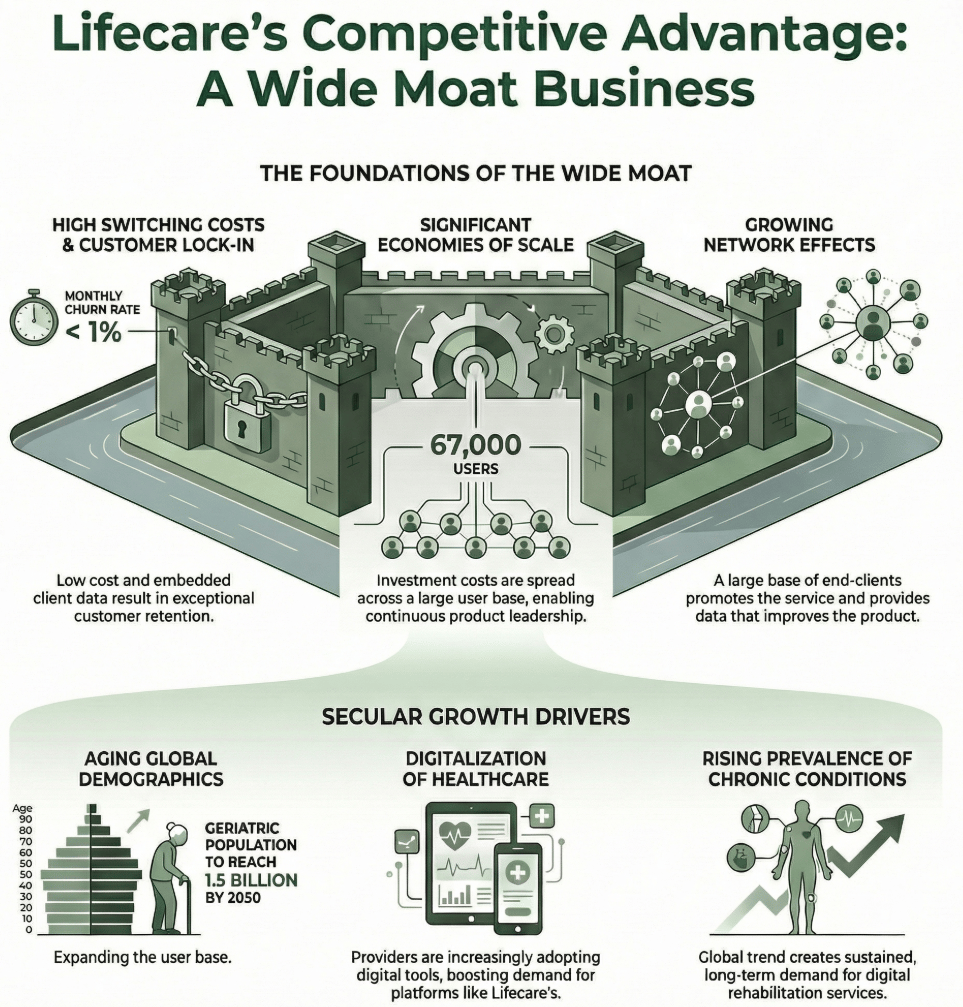

Competitive advantage in Lifecare & growth drivers

We view Lifecare as a wide-moat business. Physiotherapists, Chiropractors, and other licensed users rely on Physitrack platforms to run almost all their customer interactions.

Wide lock-in effects and switching costs - Platform users have clients and treatment history tied to it, which they don't want to lose by switching. They prefer the familiar system, and most see no reason to change. The average ARPU in 2024 was below €157. Low costs and high switching costs lead to a very stable churn rate, under 1% monthly.

Wide economies of scale - The number of exercises in the database continues to grow, and capital is allocated to improve the product. With an average of 67,000 license users in 2024, Physitrack can spread its investment costs across a significant client base and stay ahead of competitors.

Narrow network effects - The license users themselves have hundreds of thousands of clients who use Physitrack’s apps. These end clients likely promote the service themselves or are used to using the apps when visiting a new clinic, further boosting the service. Data from end-users who rate and like different exercises also helps improve the products.

There are significant macro trends that help fuel the growth and durability of the business:

Aging Global Demographic - The global geriatric population will reach 1.5 billion by 2050, up from 703 million in 2019. This benefits Physitrack's Lifecare, as older adults are more prone to musculoskeletal issues requiring physiotherapy. The aging population increasingly uses digital physiotherapy platforms.

Digitalization of Health Care - Healthcare providers are increasingly adopting digital tools like telerehabilitation, virtual reality, and wearable sensors to improve service delivery and patient outcomes, transforming physiotherapy practices.

Rising Prevalence of Chronic Conditions - A fundamental driver for physiotherapy services is the increasing global burden of chronic diseases. This prevalence creates sustained demand for rehabilitation services and digital physiotherapy platforms to manage these conditions over time effectively.

Wellness

The Wellness segment, managed through Champion Health, provides corporate clients with tools to improve employee well-being and reduce absenteeism. The platform integrates SaaS technology with virtual healthcare services, covering areas such as mental health, ergonomics, and chronic disease prevention. Key features include:

Preventive Health Platforms: A centralized employee wellness app offering assessments, stress management tools, and ergonomic guidance. Localized versions introduced in Sweden and Germany in 2024.

Virtual Care Services: On-demand consultations with physiotherapists, nutritionists, and mental health professionals. Employers pay based on measurable outcomes, such as reduced absenteeism.

Data Analytics for Employers: Aggregate health trend tracking tools that help HR teams allocate resources effectively.

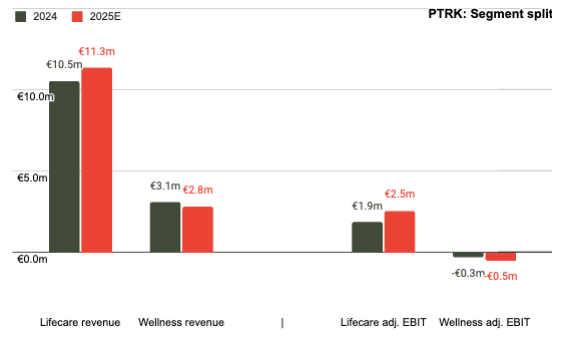

Segment split

The Lifecare segment accounts for the majority of revenue and profits. The segment is also developing well with healthy growth. Wellness is transforming as non-software revenue streams are discontinued, and it is now close to cash flow neutrality. The latest divestment of clinics and Fysiotest, etc., will further strengthen the SaaS transition within Wellness.

Recent development

PTRK has showcased strong fundamental performance and an ongoing turnaround; however, the share price is not reflecting the reality.

Q3 was another step in the right direction

Physitrack's Q3 showed improved margins and cash flow, confirming progress in its SaaS shift. Lifecare remains profitable, while Wellness nears breakeven after rightsizing. The market overlooks the rising cash flow and earnings quality.

Revenue rose 6% YoY to €3.5m, with subscriptions at 88%—a record high. Adjusted EBITDA increased 33% to €1.2m, with a 33% margin, and EBITDA less CapEx reached €0.4m, up 297%. Lifecare revenue grew 13% to €2.9m, with ARR at €11.7m (+9%). Wellness revenue fell 18% to €587k; EBITDA–CapEx near breakeven at –€42k. Lifecare expands profitably, with ARR up 13%, aided by U.S. hires and a new London office for growth in 2026. Wellness transitions to scalable SaaS, with gross margin at 91.6%, narrowing EBITDA–CapEx loss to €42k. The focus on cash flow continues to deliver, with four straight quarters of positive free cash flow.

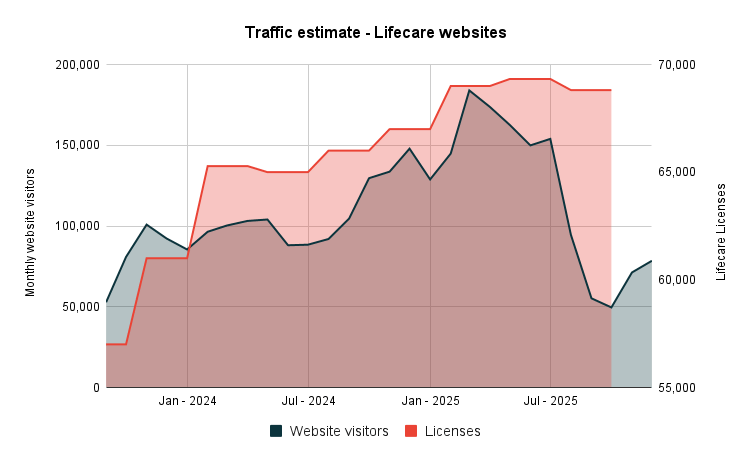

Flat license development

Licenses’ growth within Lifecare was mainly flat during the quarter, something we think warrants a closer look. We think the main site was affected by the Google core update in June, as our website visitor estimates decreased sharply.

Website visitors do not tell the whole story, as there are multiple ways for users to find PTRK’s product, but it can act as a guide for new customer intake. We model a relatively flat licensor count in Q4 but expect continued growth over the coming years. A core part of our view is that PTRK has significant latent pricing power, with the option to raise prices.

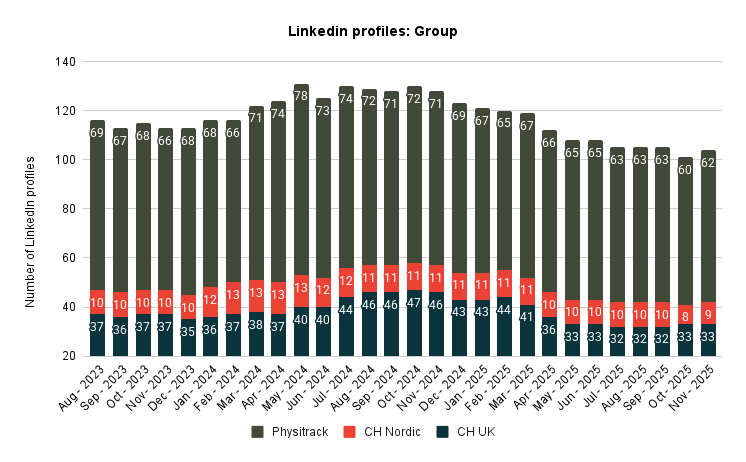

Still tight cost control

We use LinkedIn profiles as a gauge for employee development. Cost control remains tight, and there are no significant increases in employee numbers.

All this will also change with the now announced divestment.

Strategic divestment, further move to pure SaaS

On the 24th of November. PTRK announced that they had signed a Heads of Terms with the existing management team in Fysiotest Europe/Champion Health Nordics to divest the business.

The strategic reason for this move is rather apparent: it’s to shift away from legacy, low-margin revenue streams and adopt a pure-play SaaS player in the healthcare software space.

The assets are more or less given away for 1€. Not getting any return on the assets might feel strange, but the management likely believes that retaining the assets costs more than what they could get for them. Thus, it makes sense to move them away from their books, basically.

Financial effects

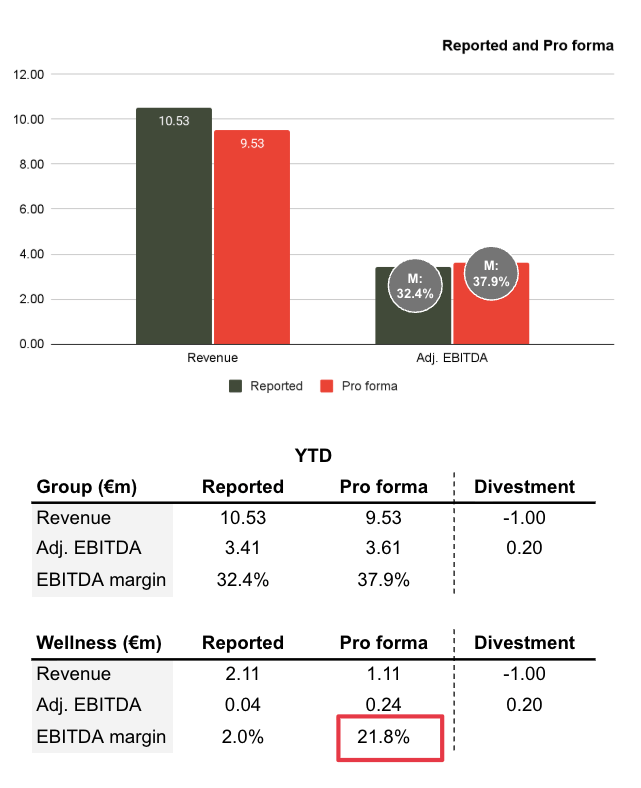

Using pro forma figures up until Q3. The proposed divested asset generated €1m in revenue, with an EBITDA impact of -€0.2m and a negative cash flow of €0.1m. For the Group, the recurring revenue as a percentage of total revenue would have been 95% without the assets.

So on an annual basis, the move will increase EBITDA by about €0.3m, and increase reported margins, but more importantly, let the company put further focus on where the long-term value lies: their SaaS platforms. What is most crucial in this transformation is that Wellness will go from an EBITDA margin of 2% to 22% with a likely net contribution to cash flow as well.

Write-downs

PTRK acquired the assets now divested, so the divestment will result in a write-down of goodwill and intangibles of €1.6m.

Furthermore, PTRK is also closing the remaining Champion Health Plus clinics. This will generate a closure-related cost of €0.2-0-3m and an impairment of goodwill and intangibles of €3m.

Unlock the rest with Premium - 30 days free access

Get full access to deep-dive equity research, discovery reports, and premium insights — no credit card required. Zero risk. Cancel anytime. Just start reading.

Upgrade