Embracer (EMBRACB): Unleashing the GOAT

Lind comments on the announced trading date of Coffee Stain and the divestment of ARC Games and Cryptic Studios.

Two announcements from Embracer today:

Announced the first day of trading for Coffee Stain Group (ticker: COFFEEB)

Divestment of ARC Games and Cryptic Studios for an expected consideration of $30m (SEK 287m).

1. The spin-off of Coffee Stain

We have written before about the coming spin-off of Coffee Stain, as we view the company as somewhat of a jewel inside Embracer, or as one could put it, a GOAT of a company.

Here are important dates to be aware of:

5 December 2025: The last day for trading in the shares of Embracer including the right to receive shares in Coffee Stain

8 December 2025: The company description is expected to be published

8 December 2025: The first day for trading in the shares of Embracer excluding the right to receive shares in Coffee Stain

9 December 2025: Record date for the distribution of shares in Coffee Stain

11 December 2025: First day of trading in Coffee Stain’s class B shares

The implied price of Coffee Stain will thus be the drop in Emracer’s share price on the 8th of December. How much value will it receive? Well, that is the question.

In our recent research report, we assigned a value of SEK 9bn to Coffee Stain. That was based on an assumption of an annual sustainable EBIT of SEK 500m and a multiple of 18.0x (the close peer, Paradox Interactive, is trading at an EV/EBIT NTM of 21x).

However, one thing an investor should be aware of is that Coffee stain will trade on Nasdaq First North (an MTF) rather than the primary market, as Embracer does. Does it matter? Well, yes and no.

It does not matter to the company or smaller investors. However, institutional ownership might be affected. Many institutional investors have limitations and can’t own companies on an MTF like First North. Vanguard (Index fund provider) is the 8th-largest owner of Embracer. What will they do with the newly printed Coffee Stain shares? Some or all of those will sell them. That could create selling pressure in the beginning, and an opportunity for the long-term investor.

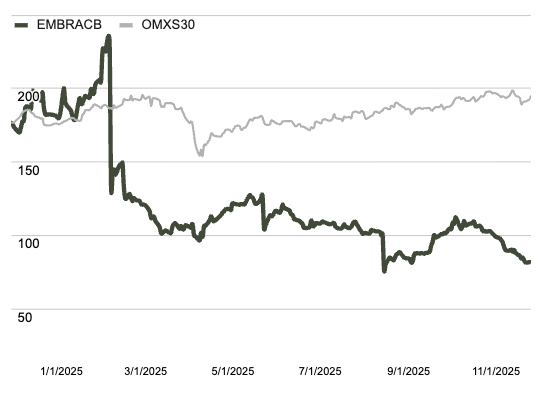

We thought it likely that the share would have a similar run-up as before the Asmodee spin-off. However, that has not happened. But we do not believe that is due to the Embracer spin-off per se. Still, more to the financial performance of Fellowship Entertainment (Embracer will be renamed to Fellowship Entertainment following the spin-off). Has any institution already sold in preparation for the event? Well volume has been shallow, so we deem it relatively unlikely.

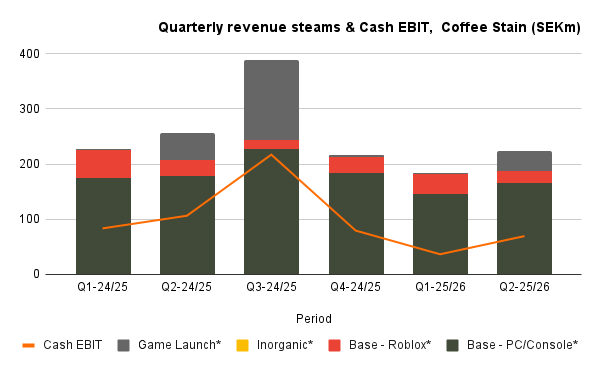

In conjunction with the CME, a lot of interesting information about COFFEEB was released. We are digging into the data and are preparing a research report on the company. We have managed to extract specific essential data points, such as quarterly estimates of Roblox (Welcome to Bloxburg) revenue and the effects on Cash EBIT. Sneak peek here:

As always, our Premium members will have first access to the research.

2. Divestment of ARC Games and Cryptic Studios

Embracer today also announced that they have agreed to sell Arc Games and Cryptic Studios to Project Golden Arc, Inc., a company owned by Arc’s management and financed by XD Inc. The deal generates USD 30m (SEK 287m) in net cash.

Embracer (soon to be Fellowship Entertainment) keeps key assets:

Remnant franchise publishing rights move to THQ Nordic (Embracer).

Fellowship (Not Fellowship Entertainment, yes, I know it’s a bit confusing), publishing rights (multiplayer game), moves to Coffee Stain ahead of its planned 2025 spin-off.

Why Embracer is Doing This

Focus on core IP and strategic assets.

Improve profitability and free cash flow.

Move Fellowship to Coffee Stain, where Embracer believes it fits better.

CEO Phil Rogers thanked the Arc and Cryptic teams and expressed confidence in their future under new ownership.

What’s Being Sold

Arc Games (publisher of Star Trek Online, Neverwinter, Remnant I–II, Torchlight, Hyper Light Breaker, Chips n’ Clawz, Fellowship).

Cryptic Studios (developers of Neverwinter and Star Trek Online).

Financials (last 12 months to Sept 2025):

Net sales: SEK 390m

Adj. EBIT: SEK –174m

EBITDAC: SEK –103m

Includes Fellowship development capex, excludes Remnant.

What Embracer Keeps

Remnant franchise

Publishing rights shift from Arc to THQ Nordic.

Remnant IP and Gunfire Games are already part of Embracer.

Arc will remain listed as co-publisher on previous titles.

Fellowship (multiplayer online game)

Rights move to Coffee Stain, ahead of its December 2025 First North listing.

Developed by Chief Rebel (35-person team, Stockholm).

Early Access launched in October 2025.

LTM capex: SEK 49m.

Coffee Stain expects neutral cash EBIT until full release.

Intangible asset value transferred: USD 18m, non-cash.

Our view

We feel this move makes sense given the financials and the price Embracer will pay. In addition, significant future potential is retained by not selling the Fellowship and Remnant rights. Overall, we view this deal as value-creative for Embracer.