Physitrack (PTRK): Strategic Restructuring Aligns With Long-Term Value Creation

Lind comments on PTRK's strategic divestment of non-SaaS assets within the Wellness segment. We view the move positively and that it aligns with our long-term investment thesis of PTRK.

On the 24th of November. PTRK announced that it had signed a Heads of Terms agreement with the existing management team at Fysiotest Europe/Champion Health Nordics for a potential divestment. The strategic reason for this move is rather apparent: it’s to shift away from legacy, low-margin revenue streams and adopt a pure-play SaaS player in the healthcare software space. Furthermore, the company announced the closure of the remaining clinics within Champion Health Plus.

The assets are more or less given away; not getting any return on them might feel strange, but the management likely believes that retaining the assets would cost more than what they could get for them. Thus, it makes sense to divest.

Financial effects

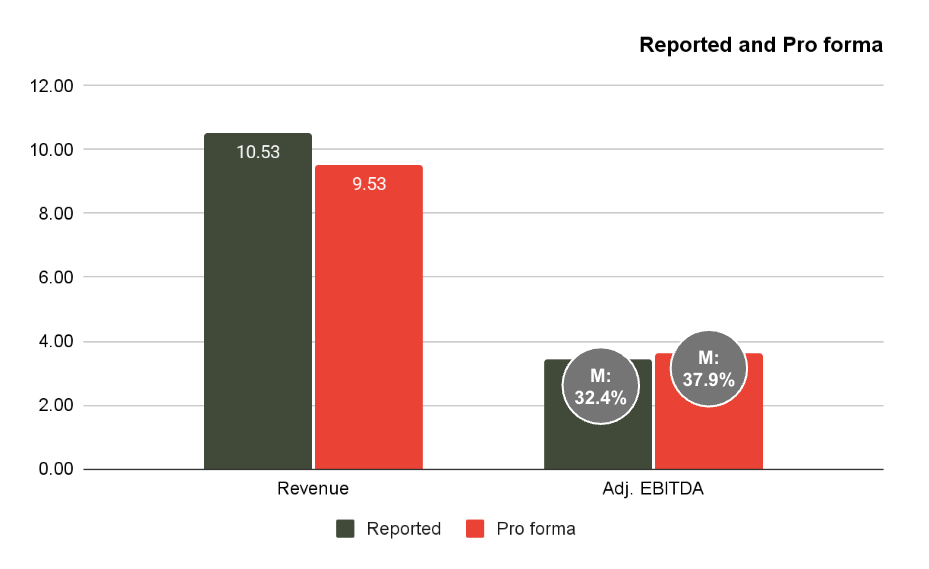

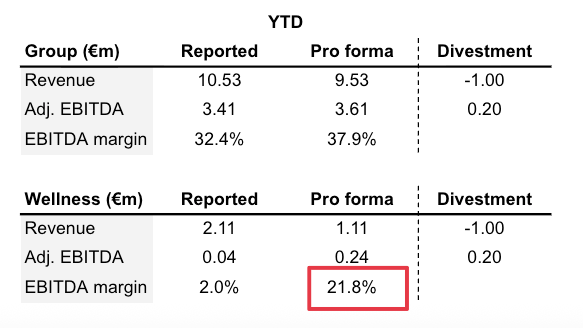

Using pro forma figures up until Q3. The proposed divested asset generated €1m in revenue, with an EBITDA impact of -€0.2m and a negative cash flow of €0.1m. For the Group, the recurring revenue as a percentage of total revenue would have been 95% without the assets.

So on an annual basis, the move will increase EBITDA by about €0.3m, and increase reported margins, but more importantly, let the company put further focus on where the long-term value lies: their SaaS platforms. What is most crucial in this transformation is that Wellness will go from an EBITDA margin of 2% to 22% with a likely net contribution to cash flow as well.

Write-downs

PTRK acquired the assets that are now being divested, resulting in a write-down of goodwill and intangibles of €1.6m.

Furthermore, PTRK is also closing the remaining Champion Health Plus clinics. This will generate a closure-related cost of €0.2-0.3m and an impairment of goodwill and intangibles of €3m.

Our view

We believe this move is the right one for PTRK. One of the core pillars of our investment thesis in PTRK is that the market does not understand the underlying quality of their SaaS business and thus does not value the company as a whole. However, as there will be further impairment and restructuring costs in the coming quarters, investors will need to dig deeper than the reported financials to understand the underlying development. To our experience, few do that exercise.

We believe that divesting clinics and non-SaaS revenue will strengthen the company's long-term outlook and likely accelerate the stock's re-rating. Our positive outlook on PTRK remains solid.

We aim to conduct a more extensive follow-up on the current value disconnect we see in PTRK, with an emphasis on the US opportunity and recent development. The report will, as always, be made available to our Premium readers first.