LIND RESEARCH

Research Report | Premium Equity Research

Wake-up Call

Sleep Cycle's share price stands at 28.7 SEK, close to its 52-week low of 23.8 SEK and far below its high of 49.4 SEK. We believe the share is attractively priced because:

The market has overreacted to the slowdown in growth: We believe the share price decline is mainly due to decreased revenue growth. Most of the issues are more cyclical than structural and will revert to normal. The development of other sleep analysis/tracking apps backs this. Sleep Cycle has actually been gaining market share, not losing it.

New revenue streams: To address the slowdown in growth from paying subscribers, Sleep Cycle has initiated multiple new revenue-enhancing initiatives. The promotion partnerships, which opened up opportunities to monetize free users, generate new B2B revenue, and facilitate sleep apnea screening, hold the most substantial promise.

Buyback opportunity: Sleep Cycle holds a substantial cash position and should utilize that money in a buyback program. At record low valuation levels, this would yield tremendous value and also signal confidence to the market.

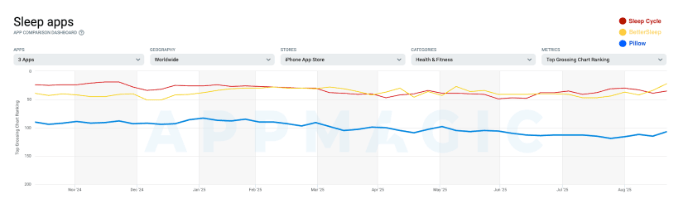

Trend shift in app store ranking: We have spotted a trend shift in the app store ranking, which, combined with rising new partner revenue, should likely lead to a Q3 beat.

The current valuation implies that Sleep Cycle is a company in terminal decline, which could not be further from the truth. The current share prices create a significant margin of safety from fair value, and we expect to see a mean reversion in the coming quarters, followed by a re-rating of the share. We rate SLEEP as Outperform with a target of 40 SEK per share within an 18-month timeframe.

Disclaimer

This analysis represents the independent views of Lind Research and is based on publicly available information believed to be reliable, but no warranty is given as to its accuracy or completeness. Nothing herein is investment advice or a recommendation. We publish openly, and companies do not influence our conclusions. Lind Research may hold positions in securities discussed.

Analyst owns shares? Yes.

Research

Description

Sleep Cycle AB (OM: SLEEP) is a Swedish sleep-tech company behind the subscription-based Sleep Cycle app, which tracks sleep, provides analytics, and a smart alarm to help users improve sleep health. The company earns its revenue from annual subscriptions from paying subscribers that amounted to 878k during Q2’25.

What triggered our interest?

We have been monitoring Sleep Cycle since their IPO and have occasionally used their product. The company appeared on a deep-value screen for low EV/EBITDA multiples, which we regularly review. After digging slightly deeper, we see an interesting opportunity at current share price levels.

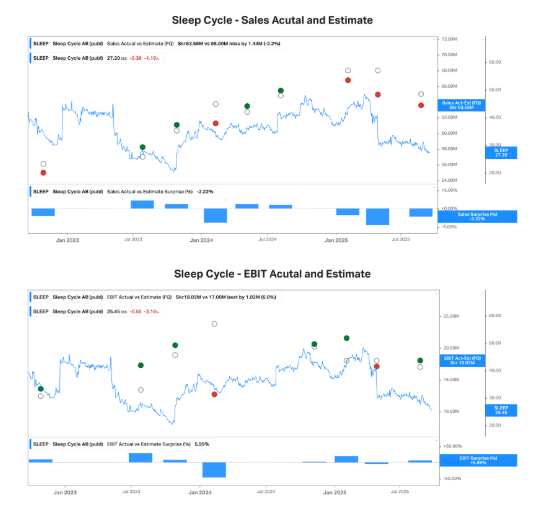

Sleep Cycle's share price saw a sharp decline following the release of disappointing Q1 and Q2 reports. It is now trading close to its 52-week low. And about 30% below its 52-week high. As shown in the chart, the most significant decline occurred during the past year, following the release of the Q1’25 report, and has since then continued.

All analysts (DNBCAR/SEB/Redeye) with coverage of SLEEP have lowered their target/fair value estimates in the past few months, primarily citing low subscriber and revenue growth as the primary concern.

Do the declines deter us? No, this is the setup we like to find potential value. Now, one must understand if the issues Sleep Cycle is facing are temporary or structural.

Market narrative

Growth concerns - Share price declines are mostly related to declining growth rates in both revenue and subscribers, as well as management team statements about a volatile environment for health and wellness apps. The market believes that the business will deteriorate further, threatened by user subscription fatigue and a slower economic environment.

If we compare market beats/misses of sales and EBIT, the underperformance has been relative to sales expectations. This suggests that the market's primary focus is currently on revenue growth. But what then is the actual reality concerning this?

Gaining market share: Sleep Cycle is not falling behind competitors but is actually gaining market share. Market trends tend to be cyclical, and CPI rates along with interest in wellness and health apps will eventually rebound. Changes in app store ranking and visibility impact the entire category, not just Sleep Cycle. Compared to major competitors, Sleep Cycle has seen an increase in app store ranking over the past few months.

New revenue streams and growth initiatives: Sleep Cycle is launching several new initiatives aimed at fueling growth and generating new revenue streams. These include:

Partnerships to expand the paying subscriber base with companies like MyFitnessPal.

New in-app promotion partners to monetize the free user base.

Sleep apnea certification which could open up an entirely new industry for the company.

Selling the core technology to potential partners and other health-related apps where sleep is not the main feature but part of the overall offering.

Growing profits: Sleep Cycle has shown slower revenue growth but increased profit growth. Profitability remains high due to cost controls and efficiency, which will help the sleep cycle when market conditions improve. The strong will survive, and Sleep Cycle remains financially very healthy.

Variant perspective

To make money in investing, you have to have a different view than the market and be right. This is our variant perspective backed by evidence.

Cyclical swings, not structural: The issues regarding the market are more cyclical than structural, which means that there will be a mean reversion to more favorable market conditions again for health-related apps. The topline has also been heavily affected by the weakened dollar, which we also…

Unlock the full Research report.

Unlock the full research report with Premium - 30 days free access

Get full access to deep-dive equity research, premium insights, and more - no credit card required. Zero risk, Cancel anytime.

lindresearch.com