Idea note

This is an Idea note; It’s a collection of early signals – companies mentioned in fund letters, blogs, or by sharp investors online. Not a full pitch, just a starting point for ideas that might be worth a more in-depth look.

Danish Medical Device Leader Trading at Multi-Year Low Despite Dominant Market Position and Structural Growth Tailwinds

Idea source: Carnegie All Cap

Price 610 DKK (2025-06-24)

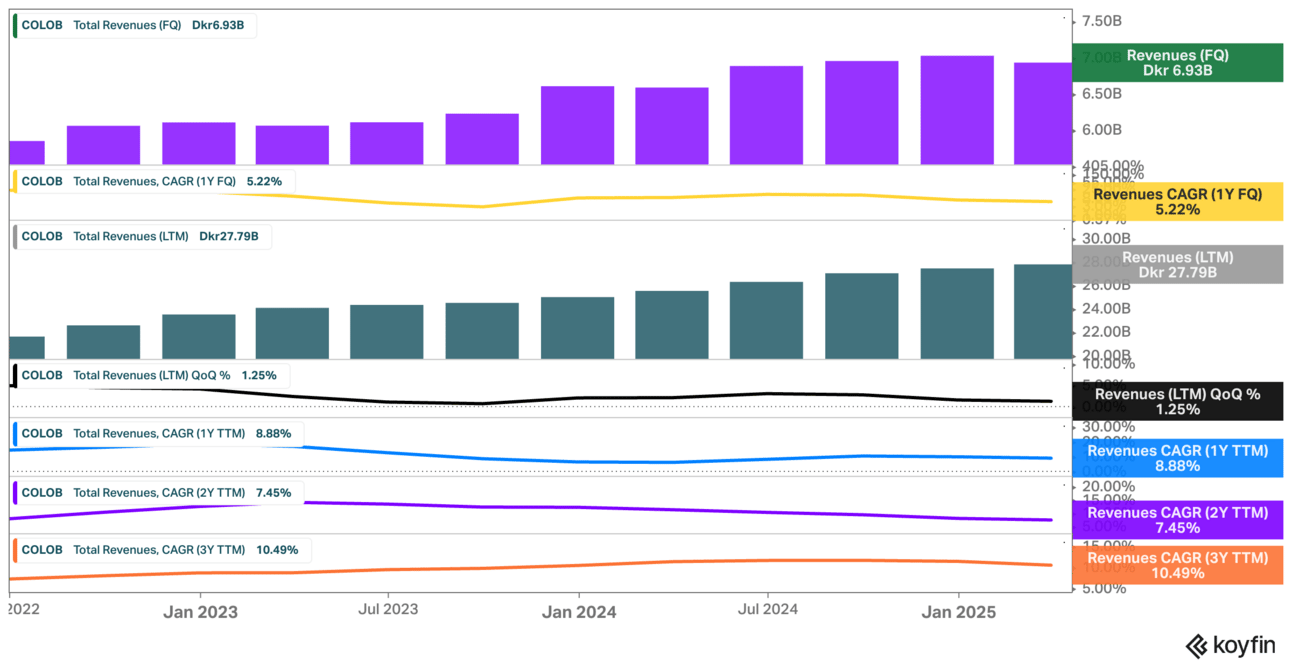

Coloplast A/S is a Danish medical device company specializing in intimate healthcare products including ostomy care, continence care, wound care, and interventional urology, serving over 2 million patients globally with dominant market positions in niche chronic care segments.

Ticker: COLOB | Timeframe: 12-18 months | 🔁 Turnaround

Carnegie All Cap believes Coloplast presents a compelling turnaround opportunity after a challenging period marked by questioned acquisitions, product recall issues, and recent CEO departure. Carnegie All Cap observes that despite these temporary setbacks, the company maintains exceptional profitability with 27% operating margins and dominant positions in structurally growing markets driven by aging demographics. Carnegie All Cap expects that with proper leadership focus and execution, Coloplast will return to its historical strong performance, making the current 34% decline from peak an attractive entry point.

Setup: Market leader with 80%+ share in laryngotomy and strong positions across chronic care segments trading near 52-week lows due to execution issues

Latest Development: CEO Kristian Villumsen departed May 2025, replaced by experienced former CEO Lars Rasmussen as interim leader during strategic transition

Reason for Mispricing: Temporary quality issues, acquisition concerns, and leadership uncertainty overshadow strong fundamentals and market position.

Timing: New leadership provides a catalyst for a strategic reset while maintaining operational continuity.

Value Catalysts: Resolution of Interventional Urology issues, strategic clarity at September CMD, debt reduction, margin recovery.

Valuation: Trading at 21x EV/EBIT at historical lows, 34% below 52-week high despite maintaining industry-leading margins.

Risks: Continued execution challenges, reimbursement pressures, high debt levels from acquisitions limiting financial flexibility.

Disclaimer - Not Investment Advice

The content on Lind Research is for informational purposes only and should not be considered as investment advice financial advice. One should always consult a qualified professional before making any investment decisions. Investments carry risks, including the potential loss of capital. Lind Research and its authors bear no liability for decisions made based on the information provided here. All views are personal and not reflective of any company mentioned. Lind Research, it’s affilaites, personnel, clients and/or partners might hold investments in securites discussed.

By accessing Lind Research, you acknowledge and agree to this disclaimer.