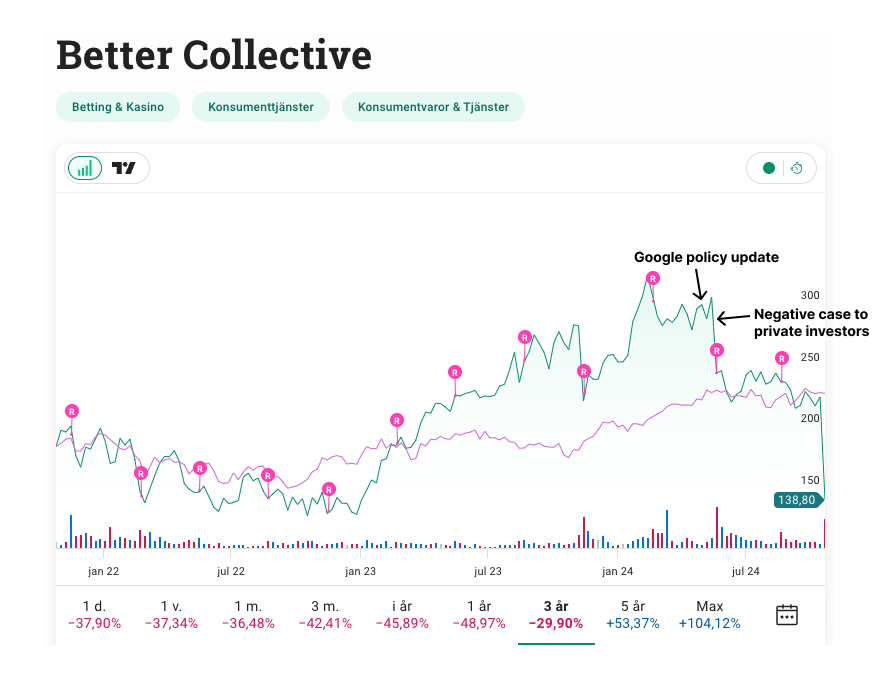

Negative case on BETCO - It still holds

Today, Better Collective (BETCO) adjusted its financial guidance for Q3 ’24 and the full year 2024 downwards. The share has reacted negatively by about -35%.

We believe the reason for the lowered guidance stems from Google's site reputation abuse spam policy update on May 7th, which heavily affects BETCO’s partner business.

When we noticed that the market did not seem to react to the spam update from Google and how it would affect BETCO we wrote a negative case on the company and sent it to a handful of professional investors.

In light of today’s share price reaction and the downgraded guidance, we found it prudent to share the case write-up broadly. At that point, the share price stood at SEK 295; now, it is at SEK 144 (down 52%).

What now?

We do not currently have a detailed view of whether the negative case is fully played out, but the impact on the partner business should be and continue to be material.

Most of BETCO’s revenue comes from revenue share agreements, and this means that it takes time before the full effect is seen in numbers. We would find it likely that the lifetime of traffic sent from bETCO to their partners would be around 9-12 months. As the spam update from Google happened in May, the effect will start to be visible in Q3’24, more so in Q4’24, and most notably in Q1-Q2’25.

Can the spam policy effect be mitigated?

There might be strategies that BETCO can initiate to mitigate the issue for them. However, the underlying problem is that “using” another site domain authority for not related content is something that Google is trying to remove.

Recently, Forbes.com has seen negative traffic trends, as it seems like Google has targeted its “partner” content. So, we do not believe that things will improve for BETCO.

Valuation and expectations

With the updated guidance, BETCO expects:

Revenue of 355-375 mEUR (previously 395-425 mEUR)

EBITDA before special items of 100-110 mEUR (previously 130-140 mEUR)

With a current Enterprise Value of 11.3bn SEK, our EV/EBITDA ratio is about 9.5x. The big question is what will happen in 2025 and beyond. If we are correct that Q3/Q€ is only the start of the problems (given the lag of revenue share agreements), then the uncertainty remains high. So, in conclusion, we still view the current valuation as not creating a large enough margin of safety, and therefore, we remain cautious.

Disclaimer - Not Investment Advice

The content on Lind Capital is for informational purposes only and should not be considered as investment advice financial advice. One should always consult a qualified professional before making any investment decisions. Investments carry risks, including the potential loss of capital. Lind Capital and its authors bear no liability for decisions made based on the information provided here. All views are personal and not reflective of any company mentioned. Lind Capital, it’s affilaites, personnel, clients and/or partners might hold investments in securites discussed.

By accessing Lind Capital, you acknowledge and agree to this disclaimer.