Welcome to Lind Research. This week, we highlight Idea notes on HUFVA, CBRAIN, RAYB, and BAHNB. We also examine insider transactions in VER, NYAB, and H100.

Idea notes

This is the Idea note section; It’s a collection of early signals – companies mentioned in fund letters, blogs, or by sharp investors online. Not a full pitch, just a starting point for ideas that might be worth a more in-depth look.

Premium Stockholm Real Estate Fortress Trading at Deep Discount - Share Buyback Catalyst Imminent

Ticker: HUFVA | Timeframe: 12-18 months | 💼 Special Situation

Richard Bråse argues that Hufvudstaden has a unique opportunity that no other Swedish real estate company can seize: meaningful share buybacks from a position of exceptional financial strength. Bråse believes that the company’s ultra-conservative capital structure, with only a 21% loan-to-value ratio and a 59% equity ratio, provides unparalleled flexibility to repurchase shares that are trading at over a 30% discount to net asset value. Bråse contends that, due to limited expansion opportunities—given the company’s focus on prime locations in Stockholm and Gothenburg—share buybacks represent the most logical capital allocation strategy. He notes that…

Read the complete Idea note here.

Danish Software Champion Positioned to Capture Global COTS Government Market

Ticker: CBRAIN | Timeframe: 18-24 months | 📈 Growth

Lannebo Teknik Småbolag believes cBrain offers a compelling investment opportunity due to its standardized F2 software platform, which enables rapid and cost-effective government digitization. The fund has identified cBrain’s competitive advantage in needing minimal customization compared to competitors’ bespoke solutions, allowing for lower prices and significantly faster implementation times. Lannebo sees positive catalysts in…

Read the complete Idea note here.

RaySearch Delivers Record Q1 Results, Positioned for Stock Price Doubling

Ticker: RAYB | Timeframe: 12-18 months | 📈 Bullish

Elementa believes that RaySearch Laboratories has delivered a transformational Q1 2025 performance, signaling a new growth phase for the leader in radiation therapy software. The fund finds that the company’s record revenue growth of 29% organically, along with operating margin expansion to 22.6% (29% excluding currency effects), demonstrates the scalability of RaySearch’s business model. Elementa identifies…

Read the complete Idea note here.

Time to Disconnect - Peak Valuation Meets Slowing Growth

Ticker: BAHNB | Timeframe: 12-24 months | 📉 Bearish

Kavaljer finds that Bahnhof, despite being a historically fantastic contributor to fund returns, now faces significant headwinds that justify exiting the position. The fund managers observe that growth has shifted from exponential to linear and has been notably decelerating in real terms recently, while profitability appears to have peaked. They believe future margin expansion is…

Read the complete Idea note here.

Insider activity

Here, we seek out standout transactions from company insiders that may indicate a need for closer examination of the company.

VERVE

Remco Westermann, CEO and major shareholder of media company Verve, has acquired an additional 207,183 shares through his investment vehicle Bodhivas. The purchases were made on both the Frankfurt (133,683 shares at €2.53) and Stockholm (73,500 shares at SEK 27.75) exchanges, totaling approximately SEK 4.4 million.

Following the transaction, Bodhivas now holds 46.05 million shares, representing 23.02% of the company’s capital and voting rights.

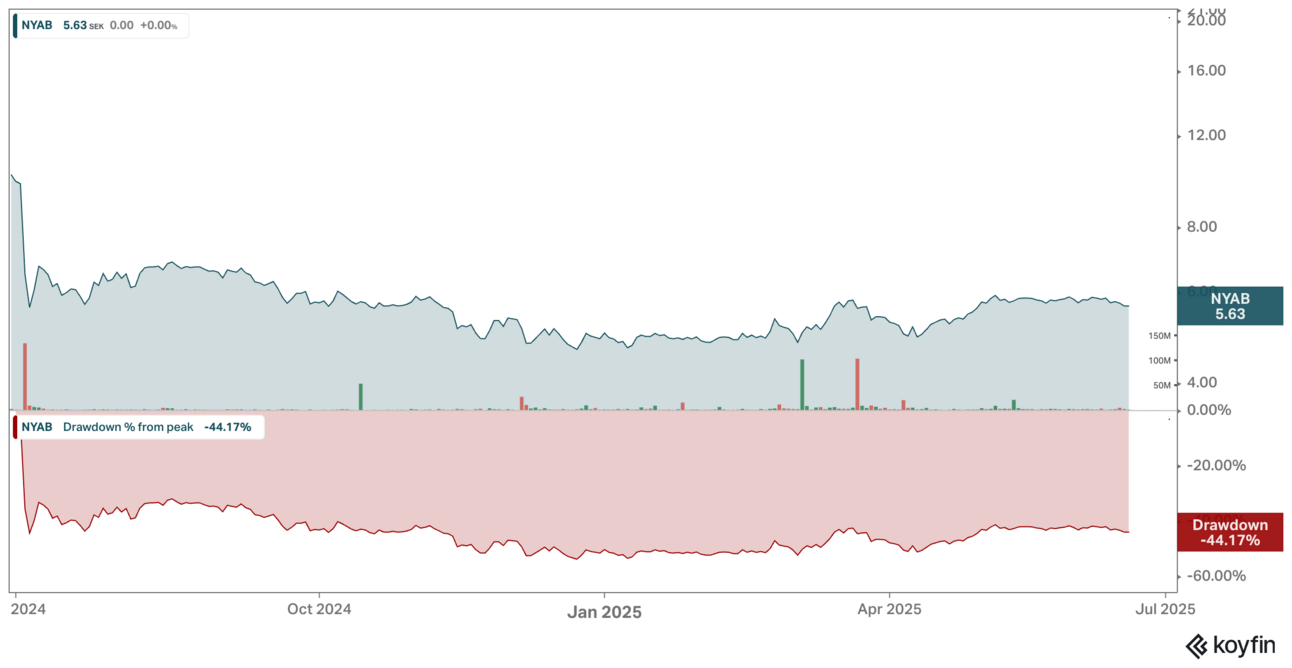

NYAB

Johan Nilsson, board member of construction company Nyab, has reported several insider purchases today, increasing his holding by 148,181 shares. The total investment amounts to SEK 841,726, with an average purchase price of SEK 5.68 per share.

H100

Eirik Nielsen, major shareholder in H100 Group, has sold 787,614 shares through his company E-Nerd on June 17. The shares were sold at SEK 11.41 each in a transaction worth approximately SEK 9.0 million, executed on NGM.

Following the sale, Nielsen holds 13.00 million shares, corresponding to 11.10% of the company’s capital and voting rights, according to data from Holdings.

Disclaimer - Not Investment Advice

The content on Lind Research is for informational purposes only and should not be considered as investment advice financial advice. One should always consult a qualified professional before making any investment decisions. Investments carry risks, including the potential loss of capital. Lind Research and its authors bear no liability for decisions made based on the information provided here. All views are personal and not reflective of any company mentioned. Lind Research, it’s affilaites, personnel, clients and/or partners might hold investments in securites discussed.

By accessing Lind Research, you acknowledge and agree to this disclaimer.