LIND RESEARCH

Research Deep-Dive | Premium Equity Research

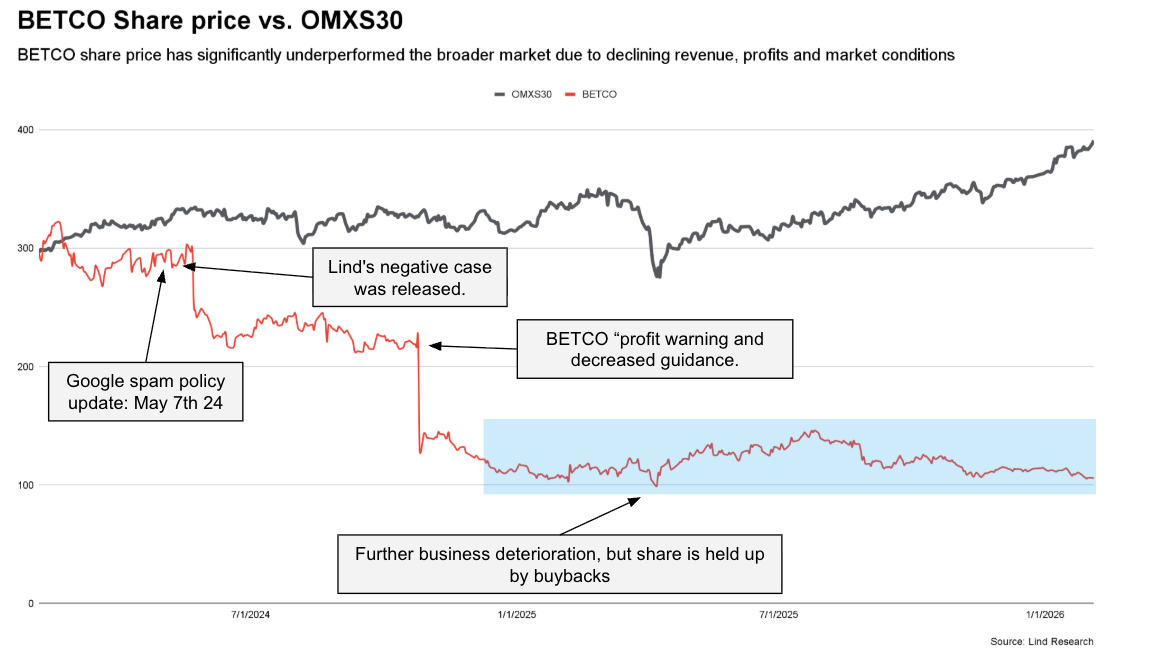

The short thesis on BETCO rests on both short-term factors like weak SEO traffic not yet appreciated by markets and a current share price artificially boosted by aggressive buybacks, but also on long-term structural challenges like AI search, the rise of prediction markets, and more.

Despite our view, the analyst or the firm does not hold a negative position in BETCO, mainly due to limiting our liability risk by expressing our thoughts.

Disclaimer

This analysis represents the independent views of Lind Research and is based on publicly available information believed to be reliable, but no warranty is given as to its accuracy or completeness. Nothing herein is investment advice or a recommendation. We publish openly, and companies do not influence our conclusions. Lind Research may hold positions in securities discussed.

Analyst owns shares? No

Structural Headwinds and Near-Term Weakness

Company description: Better Collective (BETCO) is a sports-first affiliate and media house headquartered in Copenhagen, Denmark, and listed on Nasdaq Stockholm and Nasdaq Copenhagen with a market cap of about EUR 670m.

Lind has had a negative view of BETCO since our first research report on the company was released in 2024, following Google's attempt to curb parasitic SEO practices. We continue to believe that the prospects for BETCO are weakening and will outline the reasons for our continued pessimism.

Lind believes BETCO faces near-term earnings pressure from deteriorating traffic trends and longer-term structural headwinds from a shifting SEO landscape and the rise of prediction markets. Despite this, the stock trades at roughly a 130% premium to peers with stronger fundamentals. In our view, the main support for the share price has been value-destructive buybacks, a lever that is close to being exhausted. Our one-year price target is set at 81 SEK, and our three-year price target is 68 SEK. Which can be compared to today's price of 121 SEK. Our thesis rests on the following pillars:

Summary thesis:

Traffic decline not matching market expectations: Analysts and the market are overlooking deteriorating traffic trends across BETCO’s core brands. Our SEO tracker shows clear weakness, with most sites negatively impacted by Google’s December core update. If these trends persist, Q1 earnings are materially at risk.

NDC trends do not lie: NDCs continue to deteriorate, and our analysis suggests they remain the strongest leading indicator of future revenue. In contrast, the newly introduced VoD KPI points to declining traffic quality rather than improvement. Taken together, the data challenges the company’s messaging and raises questions about whether reported KPIs are masking underlying demand weakness.

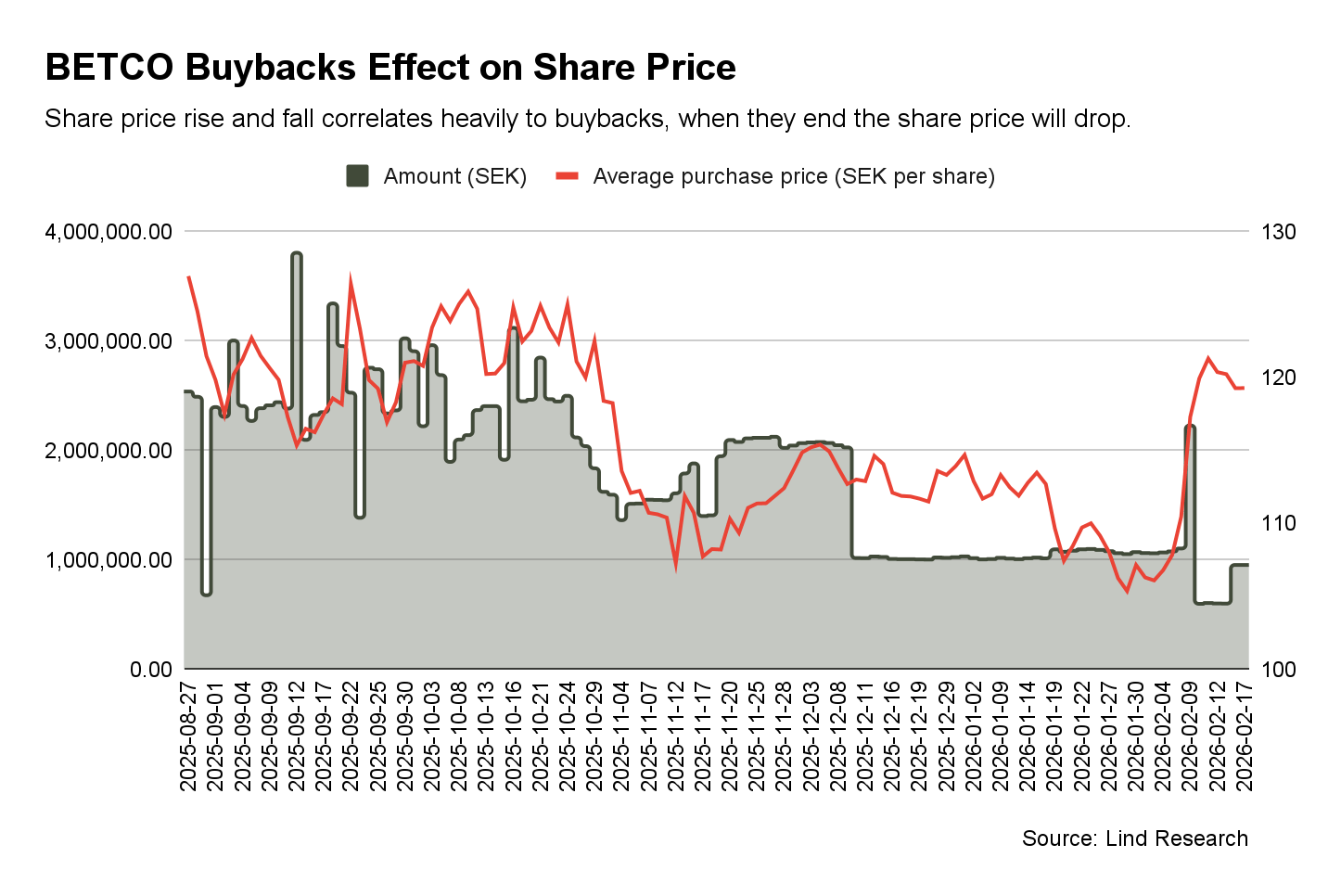

Buybacks elevate share price: Buybacks have been a key support for the share price, at times representing over 20% of daily trading volume. Since December, buyback volumes have roughly halved, and the share has weakened in parallel. While other factors may provide marginal support, we believe the buyback program has been the dominant stabilizer. As the program is depleted soon, this source of demand will fade, leaving the share price exposed to fundamental pressures.

Rise of the prediction markets: The increasing adoption of prediction markets such as Kalshi and Polymarket poses a growing competitive risk to traditional sports betting. Our data suggests that accelerating prediction market volumes are beginning to coincide with slower sports betting volume growth, indicating early signs of substitution. While regulatory and demographic factors may temper near-term impact, we view this as a structural headwind for sports betting suppliers like BETCO over time.

AI search changes the game: Google AI Overview, not ChatGPT, is the primary threat. It targets informational queries, which our data suggest account for roughly 20% of traffic to one of BETCO’s core brands. As a result, the SEO landscape is structurally changing, and over time less traffic will be directed to sites like BETCO’s. This shift has only just begun.

Regulatory headwinds: We observe a global trend of rising regulatory pressure in online gambling. In several jurisdictions, overly restrictive frameworks have reduced channelization, shifting activity toward unregulated operators. This undermines consumer protection and puts licensed operators at a competitive disadvantage. A recent example is Brazil, where the regulatory transition has negatively impacted BETCO’s business. While improved enforcement could benefit compliant incumbents over time, the near-term effect remains a structural headwind for BETCO and the sector.

Market expectations and valuation are too high: Our growth outlook is intended to reflect the structural reality and challenges ahead for Better Collective AB, including a more demanding SEO landscape, intensifying competition, and rising regulatory friction. These factors underpin a lower and less visible growth trajectory than consensus assumes, with our 2027 EBIT estimate 30% below market expectations. Even so, the stock trades at around a 130% premium to peers. We believe this valuation gap has been materially inflated by aggressive buybacks rather than fundamentals. Our SEK 81 (1YR) and SEK 68 (3YR) price targets are therefore based on a more modest growth outlook and a 12-10x EBIT multiple, compared with roughly 14x today, which we view as more appropriate given the company’s risk profile and earnings visibility.

Research Report Preview

SEO Traffic Trends Remain Dampened

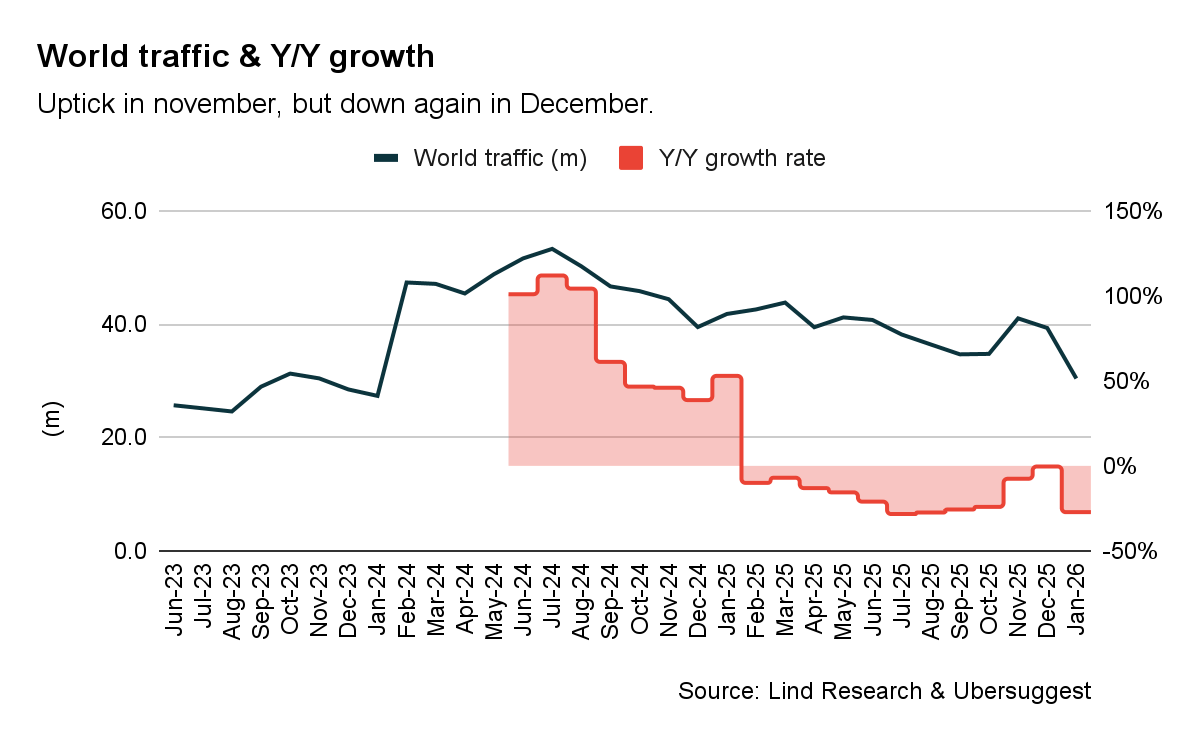

Our SEO traffic estimate for BETCO’s main sites totaled 34.7 million in October, 41.0 million in November, and 40.6 million in December. For the full quarter, the traffic estimated showed a Y/Y decline of 10.3% but an increase Q/Q of 6.5%. The increase Q/Q is expected due to league openings and increased sports activity.

Google launched a core update on the 11th of December, which was concluded on the 29th of December. It looks like a significant portion of BETCO’s site has seen a negative traffic reversal post the core update. If this continues, Q1 results are clearly at risk.

North America is picking up somewhat from Q3 but is still down slightly from last year. The most significant decline is still seen in Latin America and Europe.

Esports is stable with a slight increase compared to the previous year.

Latin America and Europe's decline is significant because they are strong monetization markets, which negatively affects revenue. If North America had increased significantly, that would have offset the decreases.

Traffic Reality Is Not Reflected in Market Consensus

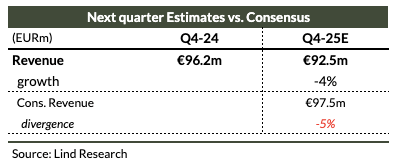

The consensus (Koyfin) expectation currently is €97.5m for Q4. That is an increase from Q3 of approximately 24% and a growth from last year of 1.4%. These numbers can be compared to our Q4 traffic estimate decline of about 10%.

Consensus sits in the middle of management's implied Q4 guidance of €77-107m, based on YTD numbers and the 2025 revenue guidance of €320-350m. Given the traffic trend, revenue is likely to land in the lower bound of the implied guidance.

Our traffic estimate diverges from the consensus expectation. Of course, revenue can be boosted by sources unaffected by current SEO-based traffic, such as paid traffic. However, paid traffic is much more affected by the competitive environment, especially around league openings. Therefore, it is an additional risk that Q4 results will come in below estimates.

We believe Q4 revenue will be around $92.5m, an increase q/q driven by league openings and seasonality, while on a y/y basis, it will decline by 4% due to lower rankings. Profitability-wise, we expect to see an increased margin thanks to the higher volume with an Adj. EBIT of €21.1m, corresponding to a margin of 23% (26%).

Buybacks Will Be Exhausted Ahead of Time

The €20m buyback program runs until March 4, 2026. So far (up until February 17, 2026), SEK 208.5m has been used under the program.

So about 95% of the program's total volume has been spent, while we are through about 92% of the time.

The buying phase has been decreased since early December, and we do not know if further adjustments will be made. But it’s very likely that the program will be exhausted ahead of time.

When Buybacks End, the Share Will Show Weakness

During the program, the correlation between rising share price and buyback volumes has been high.

Increased volumes have held up the share price, and when the volumes have been reduced, the price has dropped. For example, on February 9th, the buyback volumes jumped to 19k shares, and the price shot up directly.

We expect that if no positive news changes the current view, the share price will show weakness when the current program is exhausted, as about 20% of daily buying volume will be lost.

AI Overview Threat is the Real AI Threat

AI Overview, not ChatGPT, is the biggest threat: SEO remains the key driver of traffic to BETCO-owned affiliate websites, and SEO has changed with the introduction of both AI Search (ChatGPT, Gemini, etc.) and AI Overview. Where, actually, AI Overview (AIO) is what is impacting websites the most.

AIO is simply the search box that appears for some searches where Google tries to answer the query directly. See below for an example of searching for “vegas oddsmakers” in the USA. This is one of VegasInsiders (key BETCO website) most significant traffic keywords.

Half of the search results come with an AI Overview: Google AI Overviews have materially reshaped the search results page by answering informational queries directly in the SERP. As of 2025, they appear in roughly half of all searches, are growing rapidly, and meaningfully reduce click-through to traditional organic and paid results. The impact is uneven across query types and industries, but the overall direction is clear: Google is capturing more user attention and intent within its own interface.

20% of Traffic is under Threat by AI Overview

Informational content at risk: A key part of AI Overview is that they trigger almost exclusively on informational queries. Informational content has long been a key strategy for affiliates to capture relevant search volume that lacks direct intent but exhibits adjacent intent.

20% of BETCO’s traffic keywords is directly affected: The rise of AIO is a threat to businesses that produce informational content to capture search volume. We used VegasInsider as an example, analyzed its top 1000 traffic queries by intent, and examined the % of keywords, the % of search volume, and the % of estimated traffic.

About 19% of the top 1k queries we classify as informational, and the same for the traffic split. The volumes for these queries stand much higher, at about 47%. This is an effect of these terms' lower overall ranking compared to other intent categories, despite their significant volumes.

This data shows that roughly 20% of the traffic is under threat from AIO, as the intent is informational. This is, as we said, for VegasInsider, but we believe in general that the split will be somewhat similar for most of BETCO’s websites.

Prediction Markets Threat

Prediction markets are becoming increasingly popular and are backed by significant VC investment. Recently, one of the market leaders, Kalshi, raised $1bn in fresh funding. In November, bet volumes reached $8.3bn; two years ago, they were usually less than $50m per month.

This staggering increase in betting on these event markets has to affect sports betting volumes. And it is starting to, according to US sports data for November, the handle was about $17.7bn, ip 9% from last year. The growth trend is apparent.

The downward-sloping trend in sportsbook handle is a direct result of increased volume in prediction markets. Combining both prediction volumes and sports handles in the USA, we see that the prediction share reached a record of 29% in November.

Market Expectations Are Elevated

Our projects diverge significantly from consensus; the market expects most things to return to normal. In contrast, we argue that…

Read the rest in the Full Research Report

Lind Research