LIND RESEARCH

A New Way to Spot Software Spending Trends Before The Market

Note | Premium Equity Research

When I decide to conduct research on a company, I often ask myself whether I will be able to gain a data advantage. By that, I mean third-party data that provides deeper insight into the company that the market might otherwise overlook.

It could involve examining website traffic estimates, store rankings, Google trends data, industry information, or other sources. Well, just a few hours ago, I saw a new source of data that actually blows my mind.

This data source enables analysis of trends in estimated adoption rates and market shares of major software providers. The data source I am referring to is the newly released Ramp Rate. This is based on Ramps billing data and is anonymized. In a way, it’s similar to looking at credit card data, which is a popular but expensive data source among Hedge funds and professionals. However, this data is publicly available.

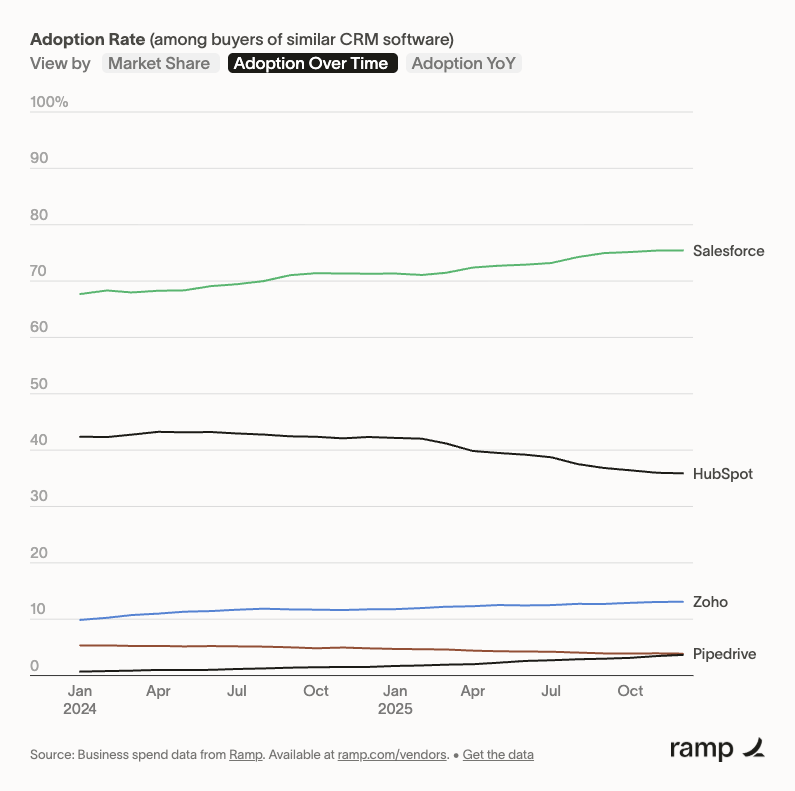

See above for the adoption rate of major CRM systems. Insights like this, with hard data, are almost impossible to obtain if you are not paying top dollar.

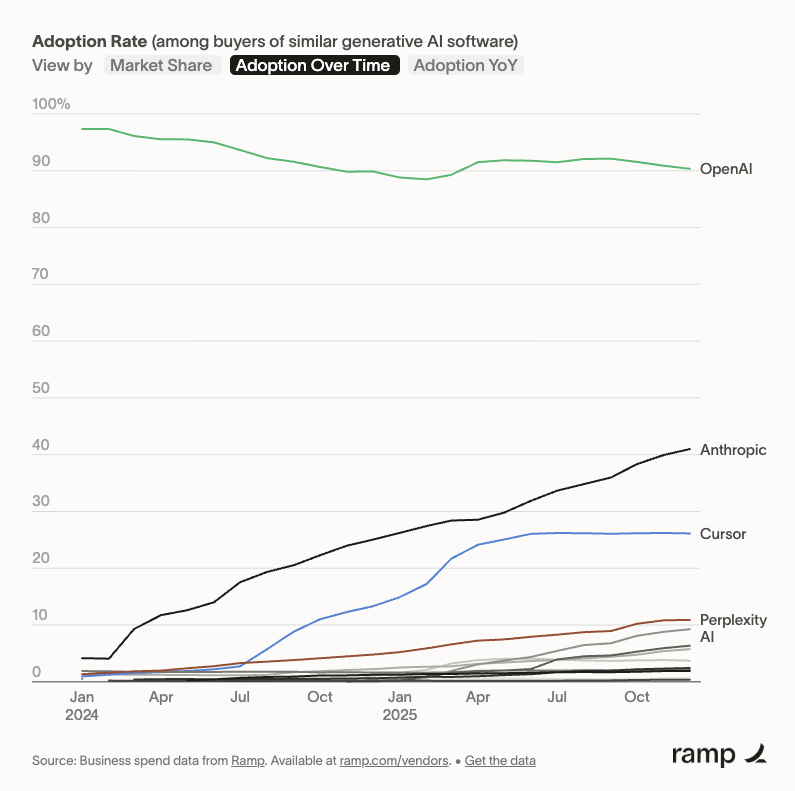

All the talk about OpenAI losing ground against Anthropic? Well seems like it.

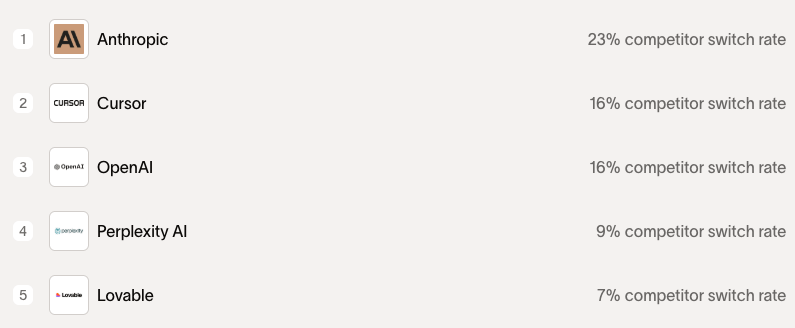

Information on most switched to, i.e., switching rate:

The data is available for download in CSV or table format.

How can this be used in investing?

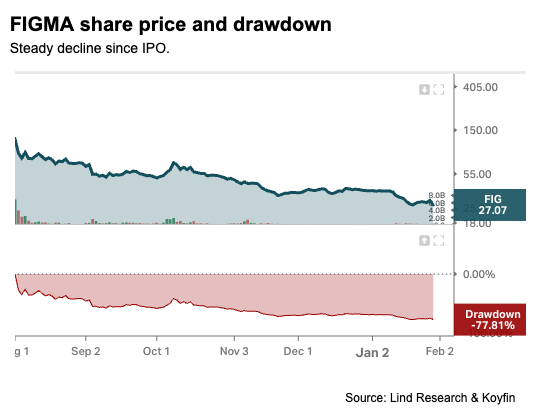

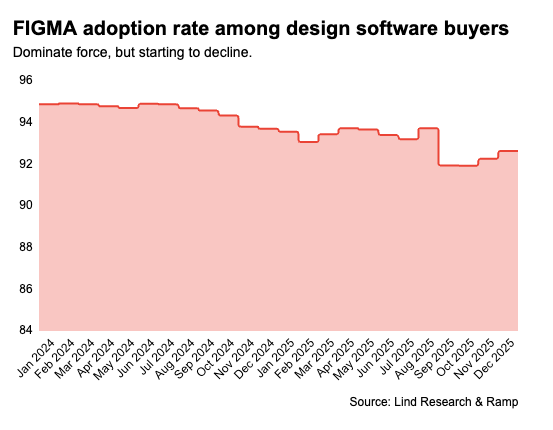

It can serve as a strong data point within a mosaic of information on revenue trends. Let’s look at the public company Figma, which has been declining steadily since its IPO with a drawdown of -78%.

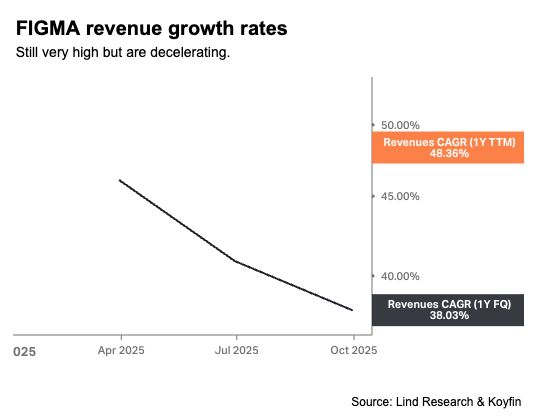

Growth rates are also decelerating, which is likely the most significant factor behind the decline in the share price.

The slight decline is evident in the Ramp data, where Figma remains the dominant player but is on the margin, beginning to feel competitive pressure.

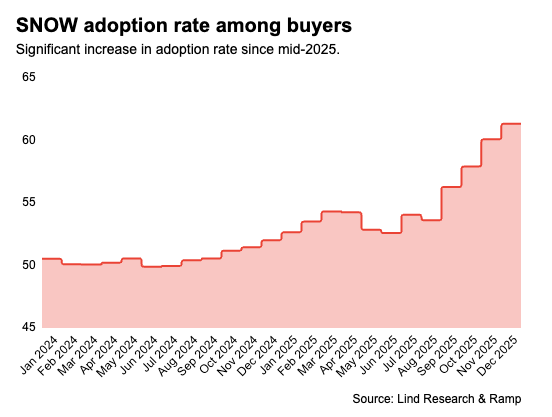

What about Snowflake, the Data Warehouse leader?

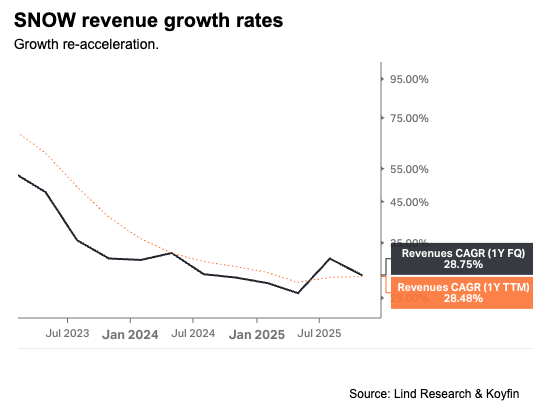

SNOW has experienced a slight revenue growth re-acceleration in recent quarters.

Well, by the looks of it, the trend will continue in Q4 with a significant increase in adoption rates.

All these insights were just from about one hour’s worth of looking around at the data.

A great data source for everyone to use

I am not saying this is the sole source of truth, and one should not make an investment decision solely on this data; however, when a curve begins to resemble this, one should at least examine the company's long-term growth rate assumptions.

Data like this is usually extremely expensive to obtain, as it is highly valuable for estimating sales trends before final figures are released. This is based only on Ramp customers, which is a limitation.

Currently, Ramp is showcasing 100 of the largest vendors, but I would expect that they add more. If the data transparency here does not lead to a backlash among their customers or the software vendors. Interestingly, we can’t search for and view adoption rates for Raps own software. I wonder why?

If everyone has this data, will its value decline? In some respects, most investors are lazy (unlike you, who read this) and will not do the work to dig into the information and draw conclusions based on it. For me, at least, this new data source is exciting, and I will use it in my research.

Disclaimer

This analysis represents the independent views of Lind Research and is based on publicly available information believed to be reliable, but no warranty is given as to its accuracy or completeness. Nothing herein is investment advice or a recommendation. We publish openly, and companies do not influence our conclusions. Lind Research may hold positions in securities discussed.

Lind Research